|

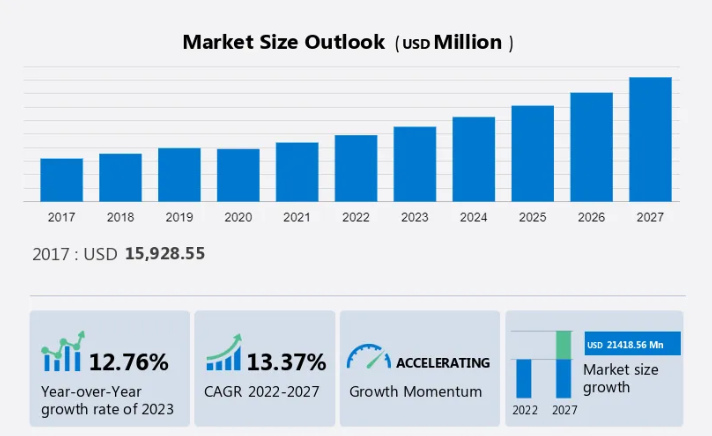

E-cigarette Market by Distribution Channel, Product and Geography - Forecast and Analysis 2023-2027Time:2023-03-22 The E-cigarette Market size is estimated to grow at a CAGR of 13.37% between 2022 and 2027. The market size is forecast to increase by USD 21,418.56 million. This e-cigarette market report extensively covers market segmentation by distribution channel (offline and online), product (modular e-cigarette, next-generation products, rechargeable e-cigarette, and disposable e-cigarette), and geography (North America, Europe, APAC, South America, and Middle East and Africa). It also includes an in-depth analysis of drivers, trends, and challenges. Our report examines historic data from 2017 to 2021, besides analyzing the current market scenario. One of the key factors driving the e-cigarette market growth is the high availability of E-Cigarette and Vapes across different distribution formats. There is a wide availability of e-cigarettes across several retail outlets such as supermarkets and hypermarkets, namely Sainsbury, ASDA, Tesco, and others. Additionally, there is a growing preference for vape cafes in the UK. There is an increase in online sales of e-cigarettes due to their convenience. Online shopping comprises remote shopping, product comparison, prepaid and postpaid payments, and doorstep delivery. Additionally, factors such as a rise in internet penetration and strong network infrastructure are fuelling the rise of online platforms offering e-cigarettes in developing countries like the UK. Hence, such factors are expected to drive market growth during the forecast period. E-cigarette Market: Overview

Key Trend and Challenge Our researchers analyzed the data with 2022 as the base year, along with the key trends, and challenges. A holistic analysis of drivers, trends, and challenges will help stakeholders in the value chain refine their marketing strategies to gain a competitive advantage. Trends A key factor shaping the e-cigarette market growth is the increasing number of E-Cigarette and Vape product launches. Successful product launches are essential for any market as it supports the growth of the market as well as the product lines of the market players. Additionally, it increases the market share of the players and provides them with a competitive advantage. For example, in August 2021, RELX Technology promoted the release of its next-generation premium e-cigarette in the United Arab Emirates and Kuwait. Similarly, in May 2022, the partnership between prominent market players Innokin Technology and Aquios Labs led to the launch of a revolutionary Lota water-based vaporizer. Therefore, such product launches by several market players are positively impacting the electronic cigarette market growth. Hence, it is expected to drive market growth during the forecast period. Challenge Stringent regulations on the sales, advertising, and marketing of e-cigarettes are one of the key challenges hindering the e-cigarette market growth. There are strict regulatory frameworks enforced by legal institutions regarding the sales, advertising, and marketing of e-cigarettes which can negatively impact the electronic cigarette market. For instance, in August 2018, the Ministry of Health and Family Welfare in India announced an advisory to all the state governments to ban the sale of Electronic Nicotine Delivery Systems (ENDS), such as e-cigarettes, HNB tobacco products, vapes, e-nicotine flavored electronic hookah, and other tobacco-based products. As a result, there was an increase in bans on the sales of e-cigarettes across several states and Union Territories such as Punjab, Maharashtra, Karnataka, Kerala, Bihar, Uttar Pradesh, Jammu and Kashmir, Himachal Pradesh, Tamil Nadu, Puducherry, and Jharkhand. Therefore, these stringent regulations can significantly impact the profit margin of market players. Hence, such factors are expected to hinder market growth during the forecast period. E-cigarette Market Segmentation by Product The wide penetration of the modular e-cigarettes segment across several markets will increase market growth. This segment offers an improved vaping experience as they have many options for customization. Also, there is an increasing preference for this segment among consumers as it enables controlling the amount of vapor, variable voltage, battery strength, and e-liquid juice. The main factor which is significantly fuelling the growth of this segment is its cost-effectiveness. Hence, such factors are expected to fuel the growth of this segment which in turn will drive the market growth during the forecast period. The increasing preference for next-generation product segments among consumers will increase market growth. There is a growing preference for the heat-not-burn devices category of next-generation products among consumers. The main feature of this product is that it heats tobacco rather than burns it, generating an aerosol that is inhaled by users. There is a growing popularity for next-generation products among health officials, policymakers, and the tobacco industry as it is considered as a harm reduction tool for current smokers. Hence, such factors are expected to fuel the growth of this segment which in turn will drive the market growth during the forecast period. E-cigarette Market Segmentation by Distribution Channel The offline segment is estimated to witness significant growth during the forecast period. One of the main segments which is significantly contributing to the growth of the e-cigarette market is the offline segment as it offers consumers various physical locations to purchase these products. One of the prominent offline distribution channels is the specialty vape shops which offer e-cigarettes and vaping products

The offline segment was valued at USD 13,468.21 million in 2017. The specialty retail stores have dedicated sections for each type of product such as e-cigarettes, e-liquids, accessories, and other vaping-related products. Additionally, these retail stores offer a unique and immersive shopping experience, enabling customers to explore various flavors, device types, and vaping equipment. Some of the major offline distribution channels which are significantly contributing to the growth of the e-cigarette market are hypermarkets and supermarkets, namely Walmart, Tesco, Carrefour, Kroger, Lidl, Coles, Woolworths, and Auchan. Hence, the increasing number of retail stores is expected to fuel the growth of this segment which, in turn, will drive the market growth during the forecast period. The growing number of e-commerce platforms are fuelling the online segment which in turn will increase the market growth. Factors such as expansive product options, online payments, and doorstep delivery and convenience are significantly fuelling the growth of this segment. Juul Labs, Vaporesso, and Eleaf are some of the prominent market players which are offering e-cigarettes through online retail platforms and have dedicated online vaper shops to cater to consumers globally. Hence, such factors are expected to fuel the growth of this segment which in turn will drive the market growth during the forecast period. Key Regions for the E-cigarette Market

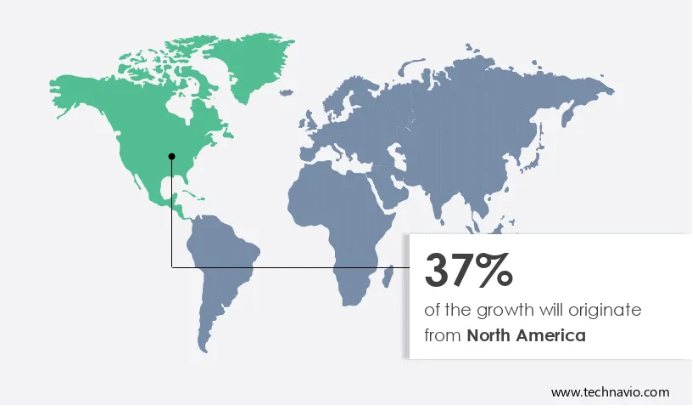

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. One of the main factors which significantly contributed to the growth of the global e-cigarette market in North America is the e increasing use of e-cigarettes among consumers. The main revenue generator of the global e-cigarette market in North America is the US, with young people being the primary consumer segment. The Centers for Disease Control and Prevention (CDC) estimated that 2.06 million American middle and high school students, including 2.8% of middle school students and 11.3% of high school students, smoked e-cigarettes over the course of 30 days in 2021. Market players in the US are offering a wide variety of flavors of e-cigarettes with new flavors being launched frequently. Also, the increasing perception that vaping and e-cigarettes have a fashionable appeal. This is fuelling market growth in the region during the forecast period. In 2020, during the COVID-19 pandemic, the growth of the global e-cigarette market witnessed a significant slowdown due to the temporary closure of manufacturing facilities and disruption in the supply chain in North America. However, in 2021, the initiation of large-scale vaccination drives lifted the lockdown and travel restrictions, which led to the resumption of industrial production and transportation activities. Such factors are expected to drive the market during the forecast period. Key E-cigarette Market Companies Overview Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. · Key Offering - Altria Group Inc: The company offers E-cigarettes through its subsidiary called Green Smoke Inc. · Key Offering - British American Tobacco Plc: The company offers handheld, battery-powered E-cigarettes that heat a liquid, also called an E-liquid to produce an inhalable aerosol, commonly known as vapor. · Key Offering - ePuffer Ltd: The company offers E-cigarettes such as the SNAPS E-cigs series and disposable eco-friendly E-cigarettes. The e-cigarette market report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including: · GD SIGELEI Electronic Tech Co. Ltd. · Geekvape · ICCPP · Imperial Brands Plc · Innokin Technology Ltd. · ITC Ltd. · Japan Tobacco Inc. · JUUL Labs Inc. · JWEI Group · OXVA · PhixVapor · Shenzhen IVPS Technology Co. Ltd. · Shenzhen KangerTech Technology Co. Ltd. · Shenzhen UWELL Technology Co. Ltd. · Shenzhen Runfree Technology Co. Ltd. · White Cloud Electronic Cigarettes · SMOORE International Holdings Ltd. Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak. Customer Landscape The market research report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies. |

Copyright @ 2018 . All rights reserved.